The inherited passion for “entrepreneurship” drives families to invest in future creative businesses via private equity and venture capital, linking their past entrepreneurial success to future entrepreneurial excellence, whether inside or outside the original realm of the family. As the family owner transfers entrepreneurship to the next generations, this is often embodied by the creation of new family businesses or by supporting external ventures. Yet, a great entrepreneur does not automatically become a good investor.

Many family business owners’ ambition is to go beyond their legacy industry and thus climb up a steep learning curve to become professional investors. Oftentimes, their initial footsteps in PEVC see them rely on own network and instinct before making an investment decision.

Calista Direct Investors are specialist investors and advisers in private markets:

Private Equity & Venture Capital (PE & VC)

Extensive proprietary network to source opportunities for both Directs and Funds.

In-depth analysis of macro trends, value chain, competitive landscape and expert insights.

Ad hoc analysis and review of Directs and Funds also sourced by our families or Calista.

We leverage 50+ years of cumulative relevant experience to originate and select proprietary opportunities with risk/reward profiles tailored to our clients’ needs.

Theme-based SPV for investors, for which we can support the structuring effort, investment strategy and fundraising.

Dedicated events and webinars with experts led by Calista top management and advisers.

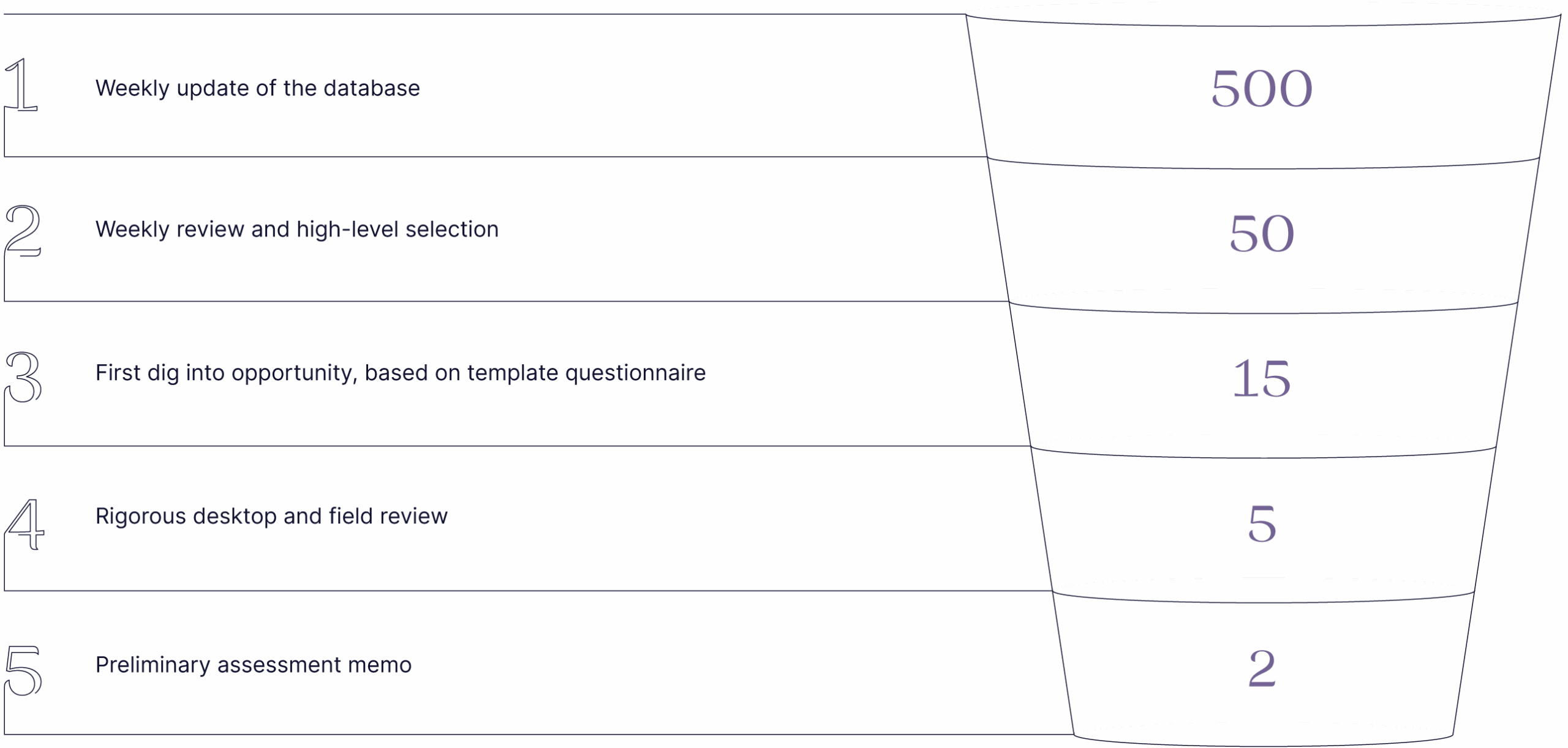

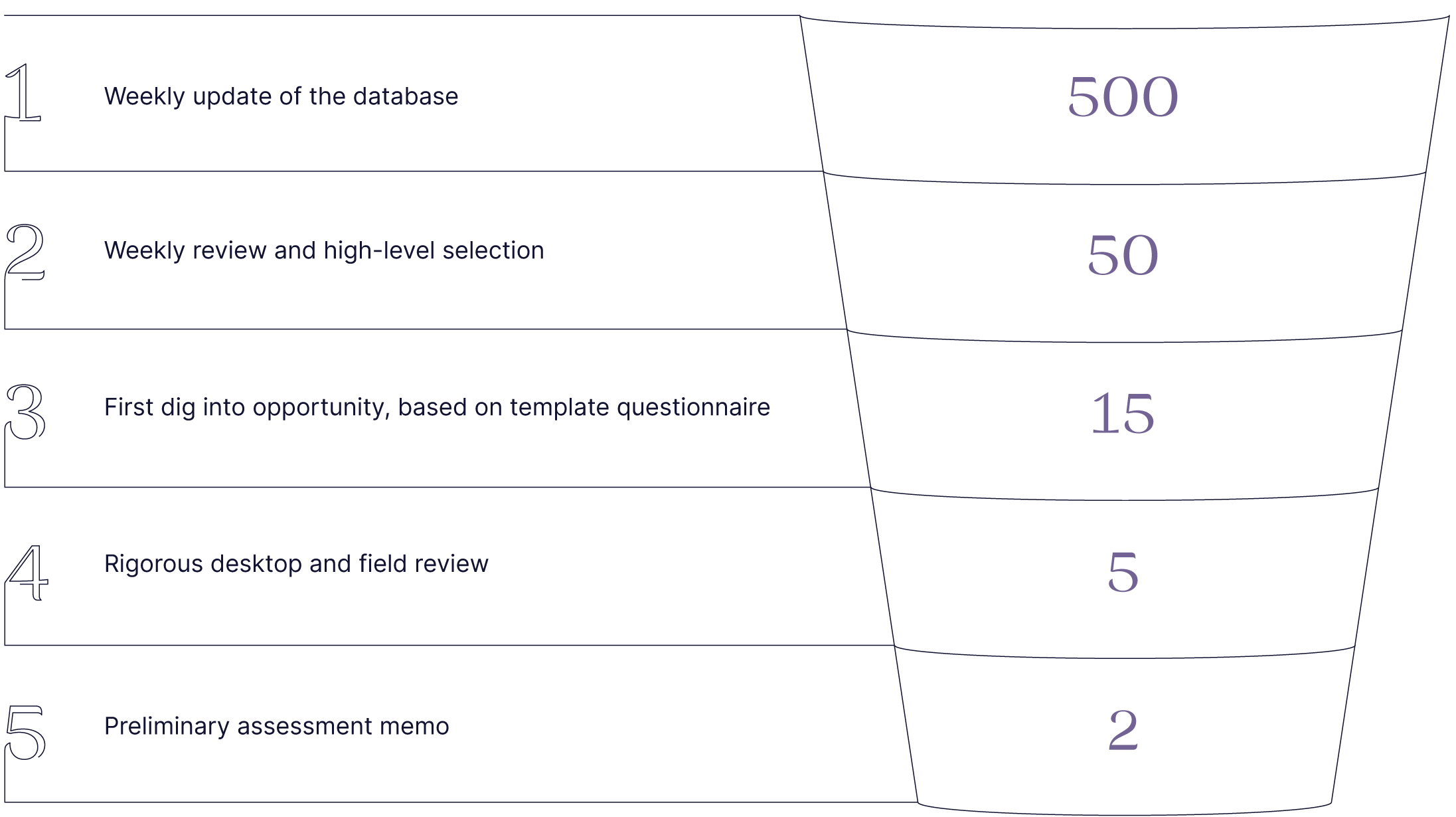

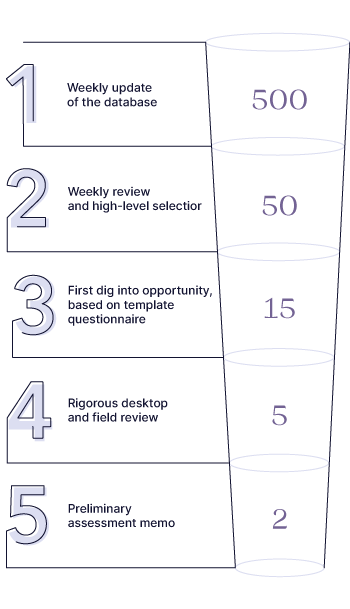

Deal sourcing and selection

Fund selection

Deal Structuring

Portfolio allocation (generic advice)

Family Offices

Portfolio reporting and consolidation

Investment monitoring and exit

Sectors we focus on stem from previous experience of our team and are meant to sustain any phase of economic macrocycle. The companies we source and select for our investors are niche disruptors and leading Family-owned /led businesses; they can be primary opportunities or co-investments alongside GPs. We also select niche fund managers that have pioneering expertise in their fields. Our pipeline also includes selected opportunities in other sectors that our investors favour.

B2B2C and D2C with a disruptive angle and leveraging new technologies

Disruptive innovations – Transformative software, AI- enabled technologies

Old is the New Economy. Cashflow generative small and mid caps that are undervalued

With a focus on payments and wealth management

Value chain, Distribution, waste reduction, productivity

Energy efficiency, urban transport, services

Services, therapeutics, MedTech, silver economy

Digitalisation of the construction industry

Digitalisation of the sports industry

Focus on digital & disruptive brands that pre-empt the cycle and break new ground